claim workers comp taxes

Most workers compensation benefits are not taxable at the state or federal levels. You can only claim a tax deduction for expenses.

Workers Compensation And Taxes James Scott Farrin

The quick answer is that generally workers compensation benefits are not taxable.

. The exception says that your. A travel tax deduction on workers compensation can be claimed at cents per mile rate for the distance traveled from your doctor to the paying authority and back home. In fact as far as the IRS is concerned workers comp falls into the same non-taxable category as welfare payments economic damages awarded in a personal injury case please note that.

Find the best workers compensation attorney serving Bellport. The earned income tax credit EITC is available if you are a low- or moderate-income worker. Do you claim workers comp on taxes the answer is no.

According to the IRS you do not have to pay income taxes on benefits paid under workers compensation. Do you have to pay taxes on workers comp settlement money. So even if part of their benefits is taxable its unlikely.

Check the WA SUI and Employment Administrative Fund option. If your tax adviser wants to know. Since they are already based on two-thirds of your wages it would be counterproductive to take out taxes in addition to that.

But there is an exception if youre also getting other disability benefits. You will not pay tax. Report the amount on line 14400 of your Income Tax and Benefit Return to calculate your eligibility for any other.

Workers comp benefits are obviously not an expense on your part. The amount of workers comp that becomes taxable is the amount by which the Social Security Administration SSA reduces your disability payments. It makes sense that workers compensation benefits are not taxed.

If SSA lowers your. Do you claim workers comp on taxes the answer is no. Your workers comp wage benefits are generally not subject to state or federal taxes.

But here we go again if you also receive Social Security Disability benefits you may need to include a portion. Workers compensation is payable on a weekly or bi-weekly basis based on the injured employees average weekly wage. Claiming Workmans Comp on Your Taxes for Earned Income Tax Credit.

You are not subject to claiming workers comp on taxes because you need not pay tax on. Compare top New York lawyers fees client reviews lawyer rating case results education awards publications social media. Up to 25 cash back If youre eligible for temporary disability payments or permanent disability benefits through workers compensation those benefits are generally tax-free at the state and.

He has lectured extensively to labor unions and medical. Romano litigates workers compensation claims including cases involving occupational exposure asbestos and industrial irritants. May 31 2019 443 PM.

Select the Tax exemptions drop-down arrow. Is Workers Comp Tax Deductible. To record the exempt for Workers comp.

It doesnt matter if theyre receiving benefits for a slip and fall accident muscle strain back injury. No you usually do not need to claim workers comp on your taxes. Reporting promptly to the Treasury Inspector General for Tax Administration TIGTA any claims or allegations of workers compensation fraud.

Workers Compensation Benefits Are Not Taxable. Regarding your question. From IRSs Publication 525.

Thats because most people who receive Social Security and workers comp benefits dont make enough to owe federal taxes. Maintaining a copy of the. Workers compensation is generally not taxable and is not earned income so it would not qualify you for EITC.

However a portion of your workers comp benefits may be taxed if you also receive Social. Income from the WCB will be reported in Box 10 of the T5007 slip. Regarding your question.

Workers Compensation for a total disability is equivalent to two-thirds.

Do I Have To Pay Taxes On A Workers Comp Payout Bachus Schanker

Unemployment Benefits And Worker S Compensation Faq Law Offices Of Cleveland Metz

Is Workers Compensation Taxable In North Carolina Riddle Brantley

Ny Workers Comp Max Settlement Amounts Paul Giannetti Attorney At Law

Is Workers Compensation Taxable In North Carolina Riddle Brantley

Is A Workers Comp Settlement Taxable Victor Malca P A

Is Workers Comp Taxable No Unless

Get Workers Compensation Insurance For Your Small Business Gusto

How Does Workers Comp Affect Taxes Business Com

How Does A Workers Comp Claim Affect The Employer Pie Insurance

Is Workers Compensation Taxable The Turbotax Blog

Dor Unemployment Compensation State Taxes

Workers Compensation Reimbursement For Mileage Rechtman Spevak

Is Your Personal Injury Or Workers Comp Money Taxable

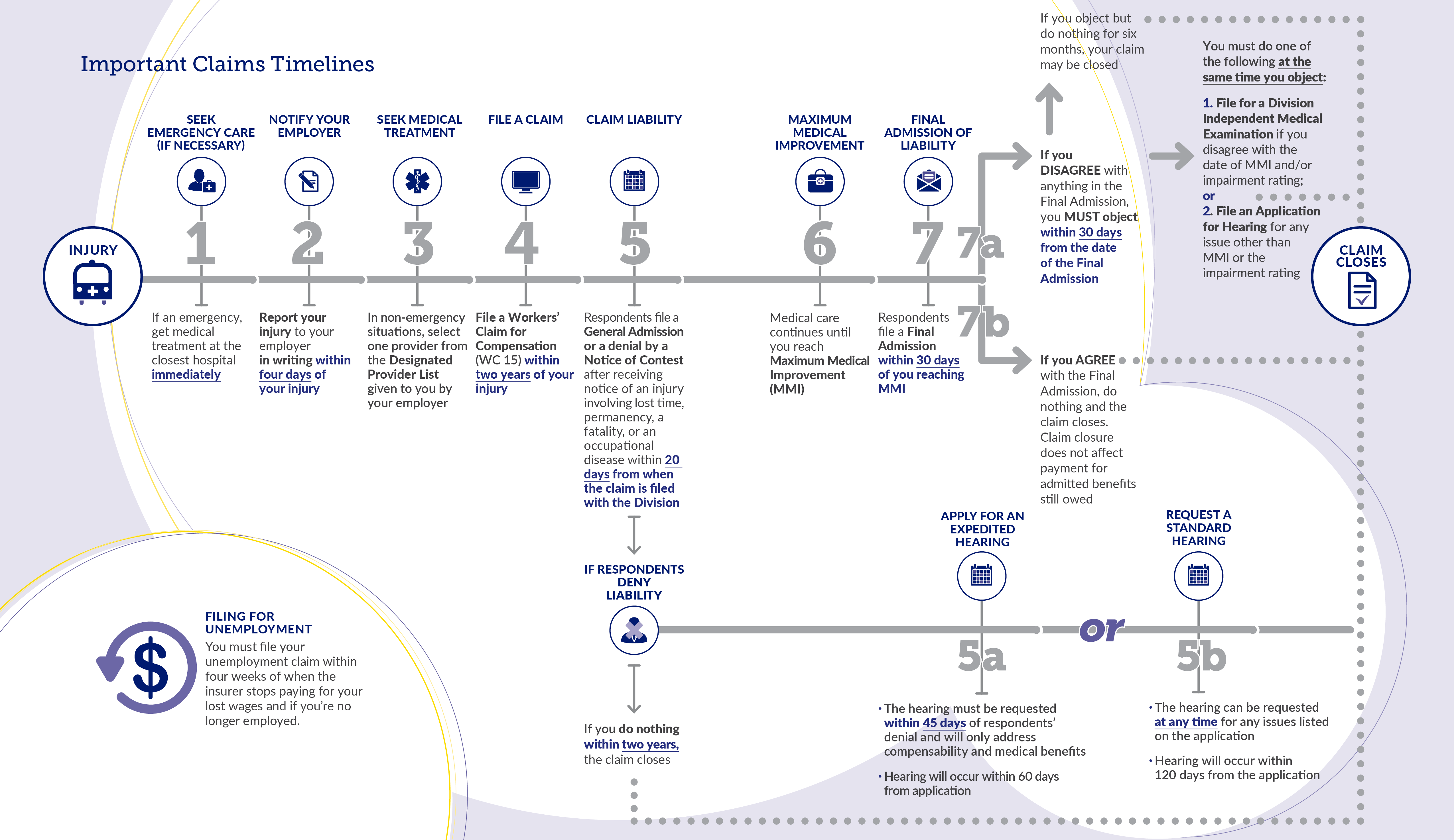

Steps To Filing A Workers Compensation Claim Halt Org

![]()

Worker S Compensation Worker Resources

Do I Need To Claim Workman S Comp On My Tax Returns

Paying Taxes On Workers Compensation In Florida Johnson Gilbert P A